Authored by Matt Waters

Wealth transfer planning often comes with a trade-off: give assets to the next generation and lose access, or retain access and risk estate taxes. Enter the Spousal Lifetime Access Trust (SLAT), a sophisticated planning tool that allows couples to transfer wealth efficiently while maintaining indirect access to funds.

SLATs could be particularly effective for today’s high-net-worth investor, when estate tax exemptions are high but future changes remain uncertain. They combine tax efficiency, asset protection, and flexibility in a way few other strategies can.

What Is a SLAT?

A SLAT is an irrevocable trust created by one spouse (the grantor) for the benefit of the other spouse, with the ultimate goal of benefiting children or other heirs.

- The grantor transfers assets into the trust.

- The beneficiary spouse can receive distributions from the trust for their lifetime.

- Any appreciation inside the trust grows outside of the estate.

- At the beneficiary spouse’s death, remaining assets pass to children or other beneficiaries tax-free.

In essence, a SLAT lets you “give away” assets for estate tax purposes while still maintaining indirect access through your spouse.

How a SLAT Works

- Husband creates a SLAT for Wife (or vice versa).

- Assets are contributed to the trust (e.g., appreciated stock, real estate, or business interests).

- Wife has discretionary access to income and principal from the trust.

- Over time, growth occurs outside of either spouse’s estate.

- Ultimately, assets pass to children or future beneficiaries with minimal estate tax.

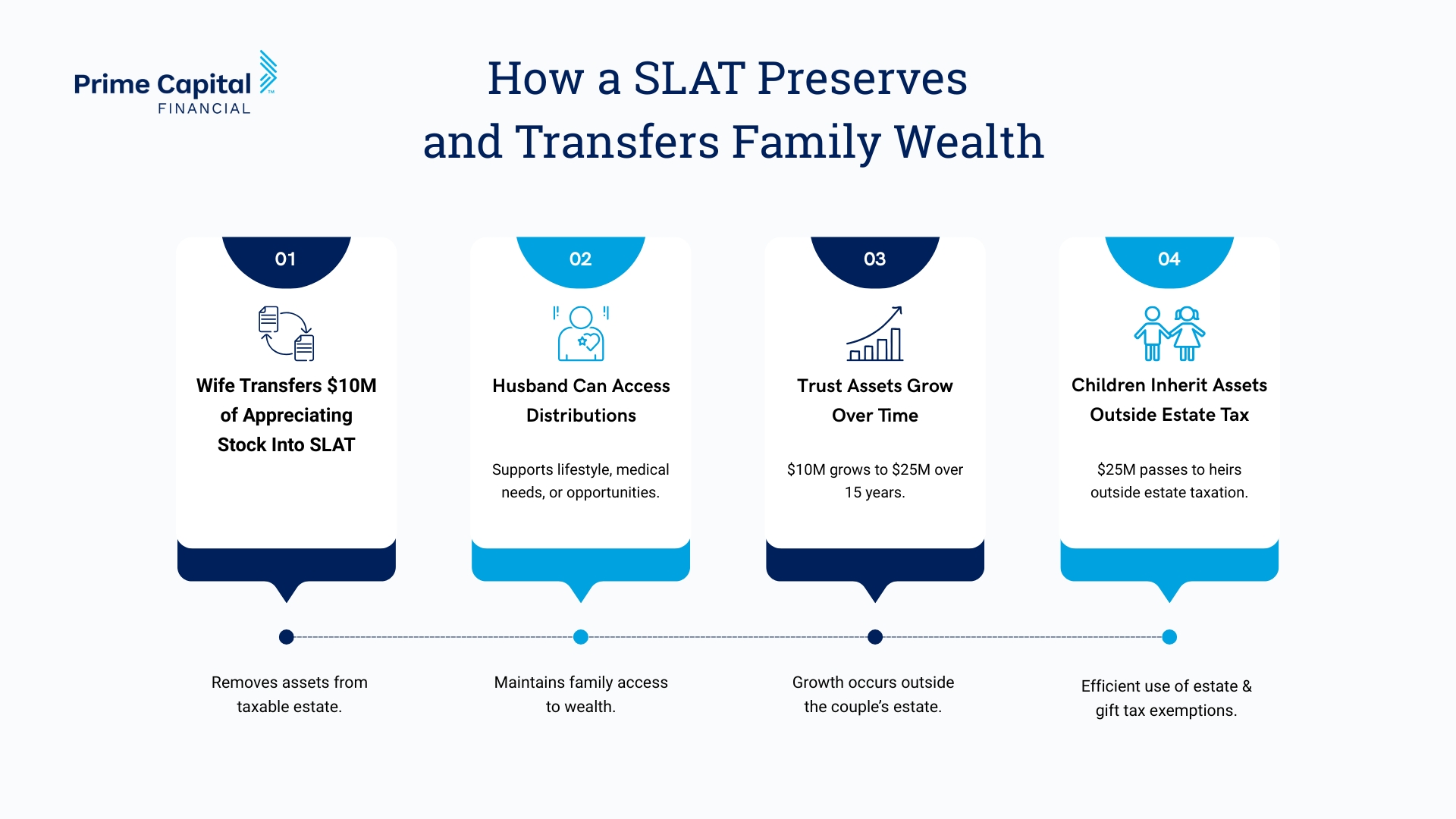

Illustrative Example

Imagine a wife transfers $10 million of appreciating stock to a SLAT for her husband:

- Husband can receive income or distributions as needed for lifestyle, medical needs, or investment opportunities.

- Stock appreciates over 15 years, growing to $25 million.

- At the end, children inherit the trust assets outside of estate taxation.

This strategy keeps wealth in the family while leveraging estate and gift tax exemptions efficiently.

This illustration is hypothetical and does not represent any client or client experience. This was developed to illustrate a potential strategy, not to guarantee a specific outcome. Your experience with our firm can and will most likely differ from what is illustrated in this strategy.

Benefits

- Indirect Access – You don’t technically own the assets, but your spouse does, giving you access through them.

- Estate Tax Efficiency – Appreciation inside the trust avoids estate taxation.

- Asset Protection – Trust shields assets from creditors and divorce settlements.

- Flexibility – Can be paired with Grantor Retained Annuity Trusts (GRATs) or dynasty trusts for multi-generational planning.

Risks and Considerations

- Reciprocal Trust Doctrine – IRS may scrutinize the move if both spouses create identical SLATs.

- Irrevocable – Once assets are in, you can’t take them back.

- Trustee Selection – Requires a strong, independent trustee to maintain credibility with the IRS.

- Income Tax – Grantor may pay taxes on trust income if trust is a grantor trust.

SLATs Work Best for:

- Married couples with large estates looking to leverage lifetime exemptions.

- Families with appreciating assets poised for long-term growth.

Couples comfortable with irrevocable trust planning and multi-year strategies.

Final Thoughts

SLATs are a masterstroke in estate planning: giving assets away without truly losing control, maintaining flexibility, and help to provide growth benefits to the next generation efficiently.

For wealthy families, SLATs can provide a balance between control, protection, and tax efficiency — a rare combination that makes them an essential tool in the modern estate planner’s toolkit.

If you’re curious whether a SLAT is appropriate for your financial situation, we should talk.

This information does not constitute legal advice. Prime Capital Financial and its associates do not provide legal advice. Individuals should consult with an attorney regarding the applicability of this information for their situations.

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. Tax planning and preparation services are offered through Prime Capital Tax Advisory. PCIA: 6201 College Blvd., Suite 150, Overland Park, KS 66211. PCIA doing business as Prime Capital Financial | Wealth | Retirement | Wellness | Family Office | Tax Advisory.